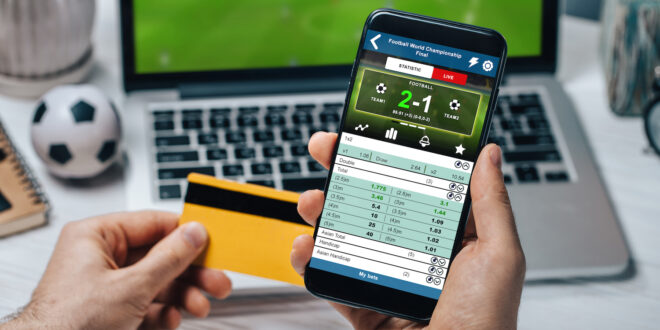

Gambling online has become increasingly popular in recent years, offering a convenient way to engage in gaming activities without having to leave the comfort of home. But with the potential for big wins comes certain tax obligations and liabilities that must be taken into consideration.

This article will provide an overview of how to maximize winnings and minimize liabilities when it comes to online gambling and taxes so that you can enjoy your gaming experience while ensuring you are following all relevant regulations. Well, look at what types of taxes apply, how you should report any winnings, and which strategies can help reduce overall liability.

Understanding Your Tax Obligations as an Online Gambler

Taxes and gambling may not be the most exciting of topics, but they are important to understand when it comes to online gambling. As a gambler, you must know your tax obligations to maximize winnings and minimize liabilities.

It is important to recognize that any winnings from online gambling activities are considered taxable by the IRS in the United States. This means you must report all of your net wins on your federal income tax return each year.

It also means that if you fail to pay taxes on these earnings, there can be serious consequences including fines or even jail time for criminal offenses. Therefore, you must keep accurate records of all of your winnings throughout the year so that you can accurately calculate what needs to be reported come tax season.

In addition, many countries have their laws regarding the taxation of online gambling winnings which further complicates matters for international players who play across multiple jurisdictions with different rules about taxing gaming profits or losses. To ensure compliance with local regulations, it is best practice for international players should consult a qualified accountant or legal professional familiar with both their domestic law and foreign jurisdiction where they gamble most often to determine their exact liability under both sets of laws before filing any returns or paying any taxes owed due on gaming proceeds abroad.

Whether playing at home or abroad understanding how taxes work about online gambling is vital if one wants to maximize profits while minimizing liabilities over time – no matter where they live!

Maximizing Winnings and Reducing Tax Liabilities

When it comes to online gambling, minimizing tax liabilities and maximizing winnings is a priority for many players. Although online gambling has become increasingly accessible in recent years, taxes are still an important factor to consider when engaging in these activities.

To maximize your winnings and minimize your liabilities, there are some key strategies that you should implement. First of all, be sure to keep detailed records of your activity on each website where you gamble.

This includes keeping track of the amount wagered, the type of game played, the date and time it was played as well as any receipts or winnings claimed from those sites. Having accurate records can go a long way towards ensuring that you maximize any deductions while paying only what’s due come tax season.

Secondly, make sure that you understand any applicable laws regarding taxes on gambling throughout various jurisdictions so that you don’t get caught off-guard by unexpected taxation liability obligations later down the line. If possible look into getting professional advice with regards to this matter; doing so could save you money if done correctly since certain deductions may not be available unless they were taken advantage of at the right times during your gaming sessions.

Finally and most importantly, practice responsible gaming habits by setting limits on how much money is spent at once or over some time when wagering online – this will help ensure that losses won’t exceed income levels too drastically leading up to filing returns which could result in high taxable amounts owed back to authorities after winning streaks have been achieved earlier in the year(s). By employing these three tips above wisely along with staying abreast with changing regulations surrounding online gambling taxation policies worldwide; players can dramatically reduce their potential future liability burden while enjoying more significant returns on their investments overall!

Strategies for Claiming Gambling Losses on Your Taxes

Strategies for claiming gambling losses on your taxes can be a tricky proposition, but there are some key tips and tricks you can use to maximize winnings while minimizing liabilities. First, make sure that all of your winnings are reported accurately; this includes documenting the date and amount of each wager along with any other related expenses.

Additionally, if youre deducting losses from online gambling activities, it’s important to keep track of the casino or site where they occurred as well as any applicable bonus codes or promotional codes used. Finally, when filing taxes be sure to include Form W-2G if necessary; this form is required for reporting certain types of gambling activity in which the player has won more than $600 in prizes.

By following these simple steps you’ll ensure that you’re properly accounting for all aspects of online gaming when it comes time to file taxes—allowing you to get the best possible return come tax season!

Exploring Different Types of Tax Deductions Related to Gambling

When it comes to gambling online, taxes play a significant role in the amount you will be taking home. While many forms of gambling income are taxable, there are several different types of tax deductions related to gambling that can help lower your liabilities and maximize winnings.

Knowing what expenses qualify for deductions is essential when filing taxes as a professional gambler or recreational gambler. Moving forward, here we explore the most common types of tax deductions related to gambling: 1) Travel Expenses – Any associated costs with traveling to participate in legal gaming activities such as airfare, hotel accommodations, meals, cab fare/ Uber rides, and car rentals may be deducted from your losses if you itemize on Schedule A.

Make sure all receipts are saved for proof of expenses incurred. 2) Professional Fees & Services – If you seek advice from an accountant or attorney regarding any type of legal gaming activity then fees paid towards their services can also be considered deductible losses.

3) Home Office Deduction – When claiming home office expenses on Schedule C or Form 8829 (for those who own rental property), certain qualifying factors must apply first before being able to take this deduction such as having an exclusive area used solely for business purposes only and no other purpose than conducting business operations within your home premises qualifies for this deduction. 4) Gambling Losses –Gambling losses up to the amount won during the same year may be deducted from the gross income they must exceed 2% of adjusted gross income (AGI). This means reporting both winnings and losses separately on each individual’s federal return form 1040-Schedule A-line 28 “other miscellaneous deductions” by totaling them up at the end which is referred to as net miscellaneous loss deduction under 2% AGI limit rule allowance set forth by IRS regulations.

These examples provide insight into some potential tax savings opportunities available when engaging in different forms of gaming activities online or otherwise; however, these rules vary depending upon jurisdiction so it’s important to consult with a qualified professional when filing taxes accordingly regarding any questions about specific details per state law requirements applicable too!

Conclusion

Online gambling is an increasingly popular pastime, and it can be a great way to make some extra money. However, online casinos are subject to taxation by the government and players need to consider this when placing bets.

To maximize winnings while minimizing liabilities, players should do their research on applicable taxes in their jurisdiction, keep accurate records of all transactions related to gambling activity, and consult with tax professionals if necessary. Ultimately, understanding how online casino gaming is taxed can help you maximize your returns without putting yourself at risk for a hefty tax bill down the line.

Alternative News

Alternative News